Adapt or Fall Behind: Why Insurers are Embracing AI

03/6/25

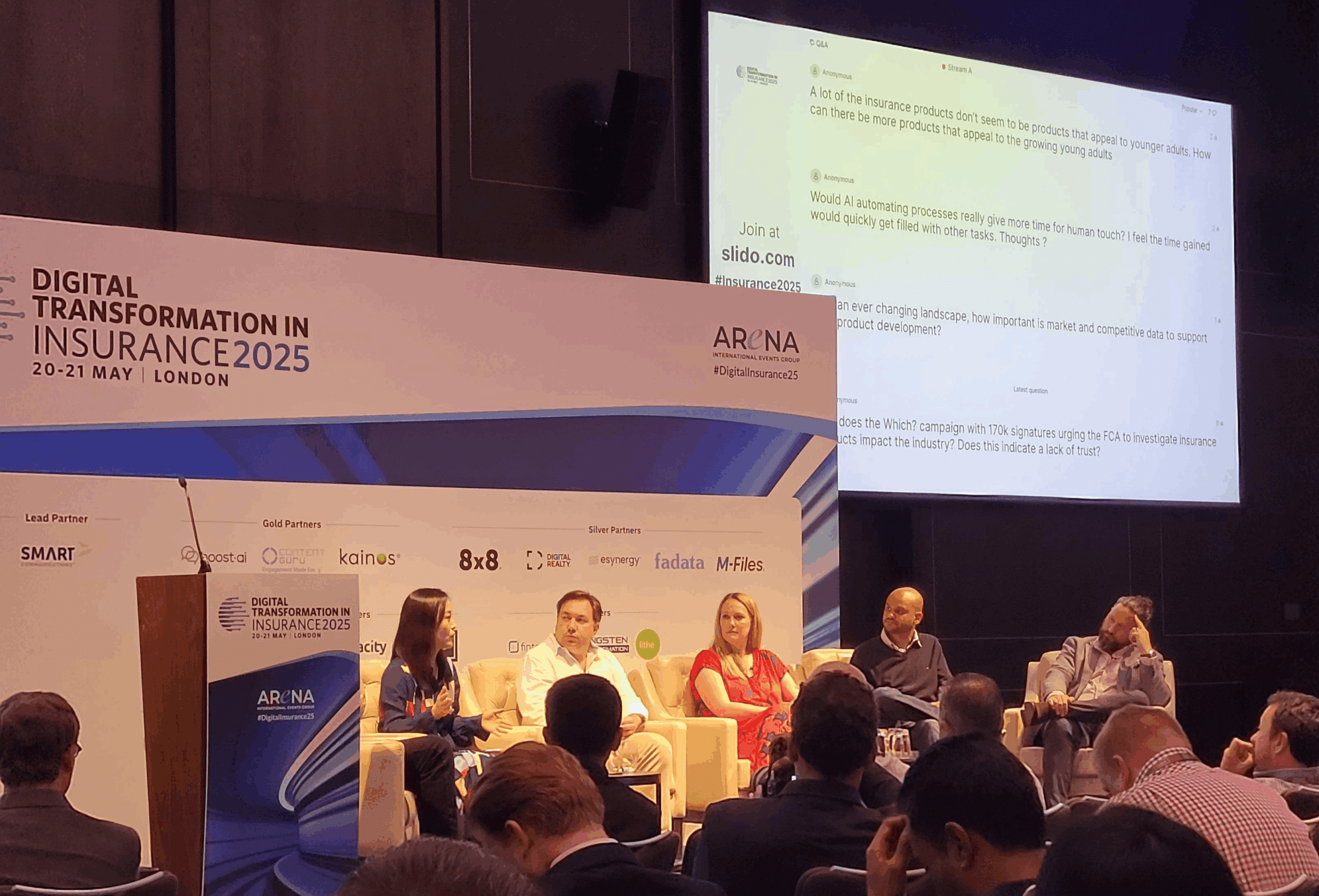

The insurance industry has long been seen as a cautious adopter of innovation, understandable in a sector built on risk mitigation and bound by heavy regulation. But at last month’s Digital Transformation in Insurance Conference, it was clear that the appetite for riding the AI wave is high. The promise of transformative industry benefits is undeniable, but it is undeniably underpinned by a shared anxiety of falling behind as a sector.

From Reluctance to Urgency

Traditionally, insurers have lagged behind some other sectors in embracing new technologies. Legacy systems, complex products, and regulatory hurdles have all contributed to a slower pace of change. The pressing need to adapt, particularly in the face of AI, surfaced at this year’s conference. A recent Grayce report revealed that 51% of C-suite executives believe their current business model won’t survive the next decade, and a third fear they won’t last five years without transformation. That urgency was echoed throughout the event.

Kath Howell, Head of Innovation at Markerstudy Insurance, captured this tension well, warning against knee-jerk reactions to external innovation news. Instead, she advocated for open dialogue across the industry as an exercise in reassurance that other insurance organisations are experiencing these same pressures. She further stressed that governance-led change is a healthier foundation for delivering lasting change within the industry.

AI: The Accelerator of Efficiency and Innovation

A recurring theme was the challenge of balancing operational efficiency with innovation. Howell noted that companies are striving to “do more with the same number of people,” and AI is proving to be the key enabler.

One standout use case from the conference came from Tryg, Denmark’s leading insurer. Bjartmar Strøm Jensen, Director, Customer AI Solutions, shared the success of their internal AI chatbot, RoSa, which now handles 97% of internal queries, supports 530,000 chats annually, and has led to an 85% reduction in support calls. The implementation has also resulted in a 75% reduction in back-office staff - a stat which no doubt made some listeners tense, tapping into a recurring concern raised throughout the conference and beyond: Will AI take my job?

Despite this headcount reduction, those who remained in role reported a job satisfaction increase from 61% to 89% in an internal temperature check survey. Amongst other things, RoSa listens in on customer calls, proactively assists agents, and streamlines backend processes, allowing the customer agents to focus on more complex customer queries.

Interestingly, AI is also being explored as a tool for regulatory compliance. Howell suggested that Gen AI could help insurers assess changes against regulatory standards before submission, potentially reducing friction with regulators, speeding up approval processes, and ultimately opening up the opportunity to drive more change.

The Rise of the AI-Literate Workforce

Conning’s Head of Data Analytics and Insurance Technology, Manu Mazumdar both emphasised a shift in workforce dynamics. AI-literate employees are becoming indispensable. Conning’s data showed a dramatic leap in AI adoption, particularly in the generative AI space, which leapt from zero in 2024 to 55% adoption in 2025, with another 44% reported to be in pilot or conceptual stages of implementation. A significant rise in the adoption of LLMs, predictive analytics, and speech recognition was also reported, painting a picture of an industry making strides in unlocking AI capabilities.

This shift will inevitably redefine roles. Madhur Hemnani, Zurich’s Head of Group Data Strategy, Data Governance, and AI Innovation, noted that AI-literate talent is rapidly becoming one of the most sought-after assets in the workforce. Recently, the conversation has evolved from generative AI to agentic AI, signalling a shift toward AI being seen not just as a tool, but as an active extension of the team.

Further to this, Prasad Prabakaran, Head of AI at esynergy predicted a decline in certain technical roles and a rise in demand for classic change management skills, from identifying opportunities and driving efficiencies, to guiding organisations through transformation.

His advice in this shifting landscape? “Intelligence is being democratised.” He encouraged listeners to focus on their organisation’s values, customers, employees and USPs.

As AI adoption accelerates, employers must take active steps to equip their workforce with the skills needed to thrive in this new era. One demographic already embracing this shift is Gen Z - according to Google Workplace research, 93% report using AI tools weekly.

At Grayce, we’re supporting leading organisations with digitally native, naturally curious change talent, equipped with foundational AI skills ready to be applied in AI-curious environments. Empowering your workforce with AI proficiency not only helps futureproof roles but also supports talent retention, ensuring your organisation remains competitive in an increasingly AI-driven landscape.

Elevating the Customer Experience

While the potential for AI to transform operational efficiency in insurance is undeniably compelling, its deployment, particularly when customer-facing, requires careful consideration. As Rebecca Haines, Head of Change and Transformation Insurance at the AA, rightly pointed out, the human touch remains irreplaceable, especially when dealing with sensitive or emotionally charged interactions. AI should be used to streamline processes and enhance responsiveness, but never at the expense of empathy or trust.

This balance between automation and authenticity is especially crucial in a sector where customer engagement has traditionally been low. Insurance is often viewed as a purchase driven more by necessity than desire, with interactions typically infrequent, and, in the case of claims, emotionally charged. Insurers are now harnessing the power of decades’ worth of data to deliver more personalised, relevant experiences, products and promotions.

By leveraging AI to process this data, there’s a real opportunity to reimagine customer journeys, moving away from one-size-fits-all policies towards offerings that are tailored to individual needs and life circumstances, in turn, improving customer satisfaction and engagement.

Hemnani illustrated these possibilities through the example of life and health insurance: AI offers the potential to not only improve customer experience but also reduce risk. Real-time data can be used to incentivise healthier lifestyles. Imagine a policy that rewards you for hitting your daily step count with perks like free event tickets or discounts on wellness products. These kinds of dynamic, behaviour-linked incentives could help lower claim risks while making insurance feel more relevant and rewarding to the customer.

Looking Ahead

The conference made one thing clear: AI is not a threat, it’s a tool. A powerful one. But like any tool, its impact depends on how it’s used. The winners in this new era will be those who educate their workforce, embrace change, and use AI to amplify human potential, not replace it.

As we look ahead, the challenge for insurers is not whether to adopt AI, but how to do so responsibly, strategically, and empathetically. The future of insurance is not just digital, it’s intelligent.

For support with your change programmes this year and to see how Grayce’s Analysts can support your next project, contact us today.